Your questions about international travel and health insurance answered!

Published on January 18th, 2024 in Travel Tips

Does My Health Insurance Cover International Travel? [FAQ]

If you’re planning an international vacation, you might be wondering what type of coverage your current health insurance plan (or Medicare) covers while you’re abroad.

In general, coverage is severely limited in these scenarios, but of course, the actual answer is more nuanced than that.

In this blog post, we’re going to field some of the most frequently asked questions surrounding health coverage while traveling abroad in a question-and-answer format. Additionally, we’ll provide some tips on where to look for coverage, how to supplement health insurance with travel insurance and travel assistance, and general best practices to make sure you have adequate coverage for your trip.

Let’s get started!

Does health insurance cover health services while abroad?

Most standard health insurance policies, including those provided by employers in the United States, offer limited or no coverage for health services received outside the country. It’s important to check your policy’s details, as some may cover emergencies but not routine care.

Does Medicare cover health services while abroad?

Healthcare coverage while traveling outside the U.S. generally isn’t included in standard Medicare plans, but there are a few exceptions.

For instance, if you’re traveling to Alaska via Canada and encounter a medical emergency, with the nearest hospital being in Canada, Medicare might cover your treatment. Additionally, there’s an option to purchase a Medigap policy, which can provide coverage for emergency medical care during international travels. Some of these plans cover medical emergency care with a lifetime cap of $50,000.

Furthermore, according to Medicare.gov, certain plans may offer coverage for emergency medical care abroad if the emergency occurs within the first 60 days of your trip and if the care isn’t already covered by Medicare. These plans might cover 80% of the billed charges for necessary emergency care outside the U.S., post a $250 annual deductible. You’ll want to contact your Medicare provider to understand the exact details of your coverage.

What’s not covered by health plans when you travel internationally?

When traveling internationally, several types of healthcare services and situations are typically not covered by standard health insurance plans, including many U.S.-based health plans:

If you suspect you may need any of these services while traveling abroad, you might consider looking into a travel assistance membership from Emergency Assistance Plus.

Should I supplement my health insurance with travel insurance?

This decision largely depends on two factors: Your pre-existing conditions and the monetary value of your trip. If you know you have a condition that will likely cause you to visit a foreign hospital or receive medical treatment while abroad, you’re likely going to want to invest in a travel insurance policy that covers your needs.

Additionally, if your trip abroad is expensive, travel insurance policies can help you mitigate your losses via trip cancellation or trip interruption insurance.

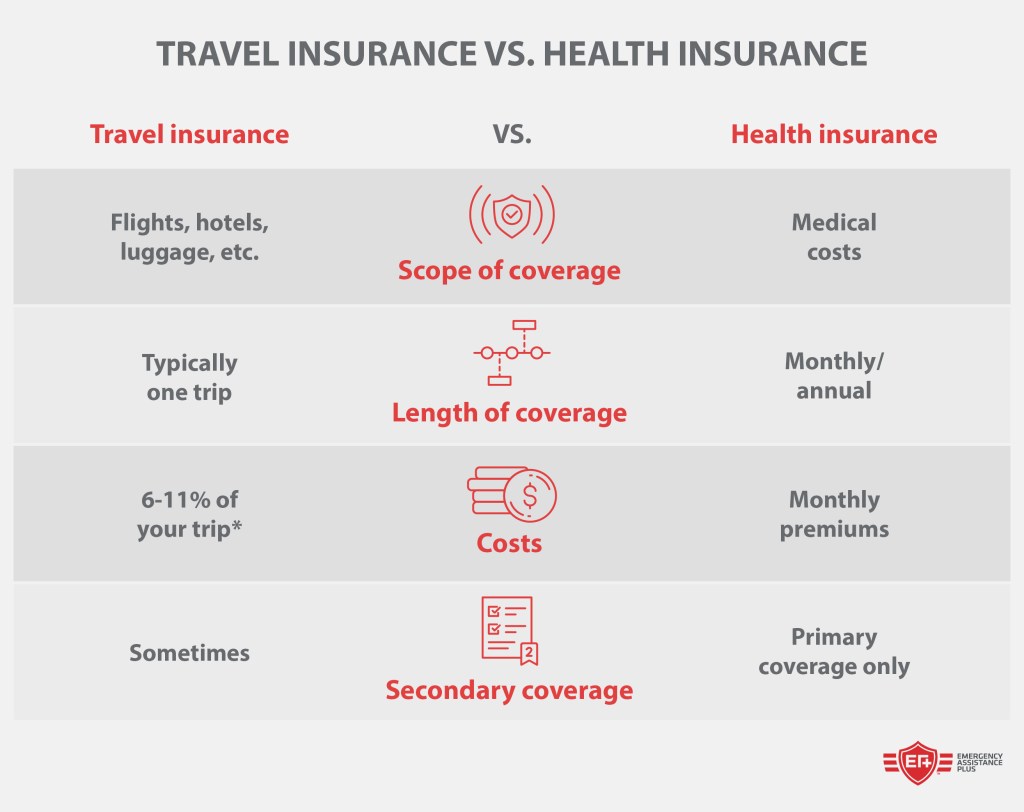

How does travel insurance differ from my health insurance?

Travel insurance guards against unexpected incidents and disruptions during travel, offering coverage for events like trip cancellations, lost luggage, flight delays, and emergency medical costs. It reimburses you for covered disruptions during your trip.

Health insurance, however, focuses on medical expenses related to illnesses, injuries, treatments, and includes hospital stays and prescriptions, offering financial support for healthcare.

Travel insurance is usually bought for specific trips with set coverage duration, including options for annual or multi-trip policies. Health insurance provides ongoing coverage, including outside travel, but often doesn’t cover international medical expenses.

The cost of travel insurance varies based on trip cost, travel duration, coverage chosen, destination risks, age, and health. Expect to pay around 6-11% of your trip’s value, considering factors like co-pays and deductibles. Health insurance premiums depend on age, health history, coverage level, and plan type (like HMO or PPO).

Related reading: Travel Insurance vs. Health Insurance

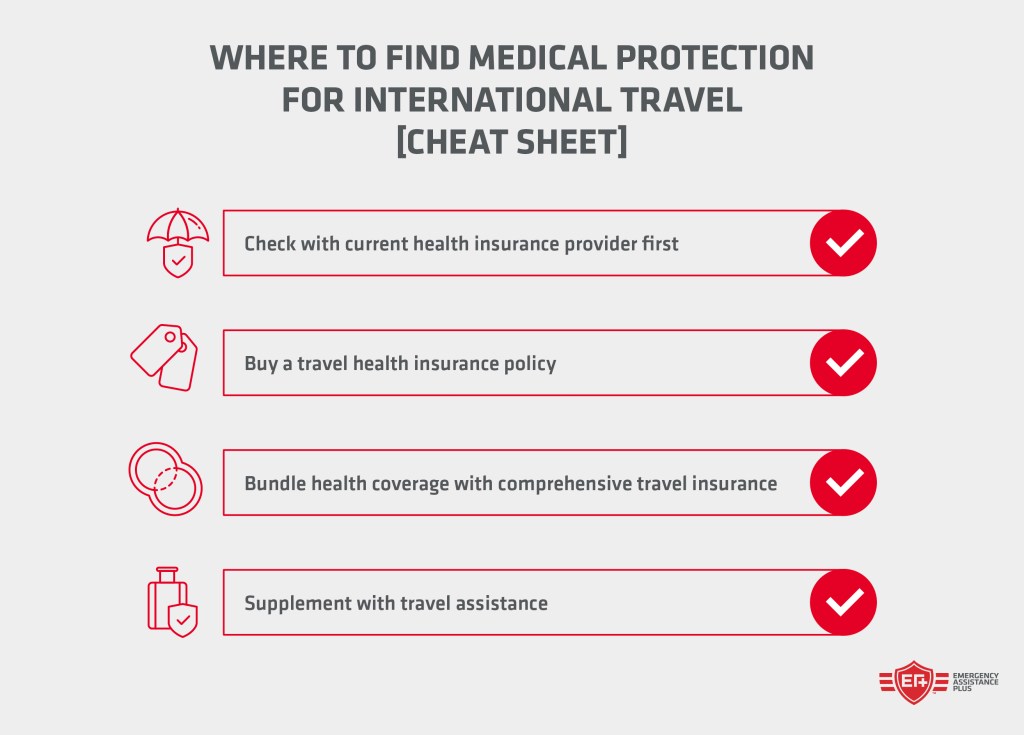

How can I get medical coverage for international travel?

You have a few different options for medical insurance and other services for international coverage.

Where should I buy travel insurance?

There are several different channels where you can buy travel insurance, each with its own advantages. Here are some common places where you can buy travel insurance:

No matter where you purchase, do your research to ensure that:

How to file a claim for medical care that was outside the U.S.

Depending on if you’re filing a claim for medical services with your health insurance plan, your travel insurance company, or somewhere else, the process might vary. However, regardless of where you file the claim, here are a few universal best practices:

Next steps

Now that you know the limits of most health insurance plans when it comes to international travel, you may want to supplement your coverage.

For travel insurance, consider getting a free quote from TripInsure Plus. With affordable rates and best-in-class coverage, it’s a great way to protect the investment of your trip. Note: TripInsure Plus is available exclusively to current EA+ members.

So when you supplement your travel insurance plan with travel assistance from EA+, EA+ members carry the assurance that, no matter if they are on a exotic vacation or just a short drive from their house, a team of expert professionals is always prepared to respond in the event of a medical emergency. This team ensures members receive the appropriate medical treatment and arranges the needed transportation back home, providing peace of mind during their travels.

Should a medical emergency derail your travel, Emergency Assistance Plus® (EA+®) has you protected no matter where you are.

Enroll TodayRelated resources

Travel Tips

Planning a trip to a remote area? Learn whether a satellite phone is a must-have for your journey, how it works, and what it could mean for your communication needs.

Continue Reading

Travel Tips

Don’t spend your whole trip in the bathroom! Learn how to prevent and/or manage traveler’s diarrhea.

Continue ReadingIf a medical emergency occurs while you’re traveling—either domestically or abroad—you want to know that you and your loved ones are well-protected. Emergency Assistance Plus not only offers that protection but the peace of mind to explore the world with confidence.