Is flight insurance from an airline a good value? Let’s investigate.

Published on December 18th, 2023 in Travel Insurance, Travel Tips

If you buy something expensive, odds are you’re going to want to protect it with insurance. This is a common practice for our vehicles, our homes, and even some appliances.

And if you’re going to spend good money on a trip that includes a flight, you might want to protect that as well.

Travel insurance on flights helps ensure that you’re reimbursed should something go wrong with your flight (so long as whatever goes wrong is covered in your policy). But purchasing protection for your flight can be confusing; people often have questions like:

In this post, we’ll clear up the confusion around travel insurance coverage types, discuss different scenarios where you might want to buy, and provide tips for making sure your flight is protected.

What’s the difference between travel insurance and flight insurance?

First, let’s clear up the wording, as “travel insurance on flights” can refer to two things:

Since we have written several articles about travel insurance in the past, today we will focus on flight insurance, the second item on the list above.

However, you may also be interested in these related articles:

What is flight insurance?

Flight insurance, also known as air travel insurance or flight protection, is a type of insurance that provides coverage for specific events and incidents related to air travel. This insurance is typically purchased for individual flights or trips and is designed to offer financial protection in case certain unexpected events occur during your flight. Flight insurance can be bought as a standalone policy, and it is usually offered by airlines, travel agencies, or insurance companies.

What does flight insurance cover?

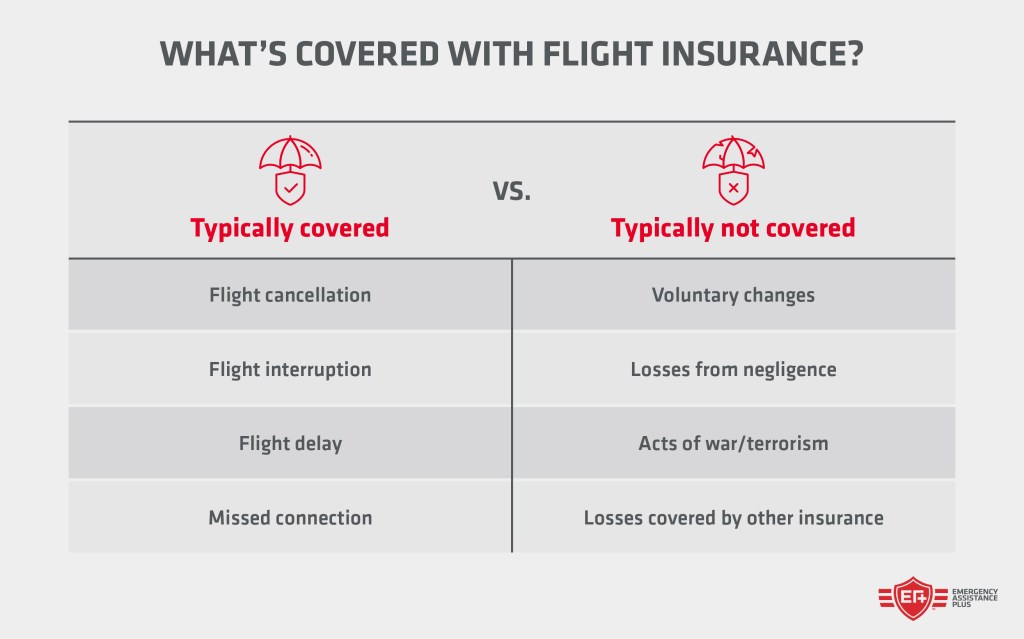

We must begin this section with a huge caveat: There is a huge variance in individual travel insurance policies. The following list contains items that are often covered, however if you need a specific area of coverage, it’s best to define that before you purchase flight insurance plans. That said, here’s a list of situations that flight insurance plans may cover:

It’s essential to carefully read the policy terms and conditions to understand the specific coverage, exclusions, and limitations of your chosen flight travel insurance plan. Additionally, policies may have different coverage levels and options, so you should select a plan that aligns with your travel needs and preferences.

What’s NOT covered by flight insurance?

Flight insurance, like any insurance policy, has exclusions and limitations that specify what is not covered. While the specific exclusions can vary depending on the insurance provider and policy, here are some common elements that are typically not covered by flight insurance:

Of course, always thoroughly read through the fine print in your policy to compare to the list above, as they might include different restrictions.

How much does flight insurance cost?

Flight insurance varies in cost depending on variables such as:

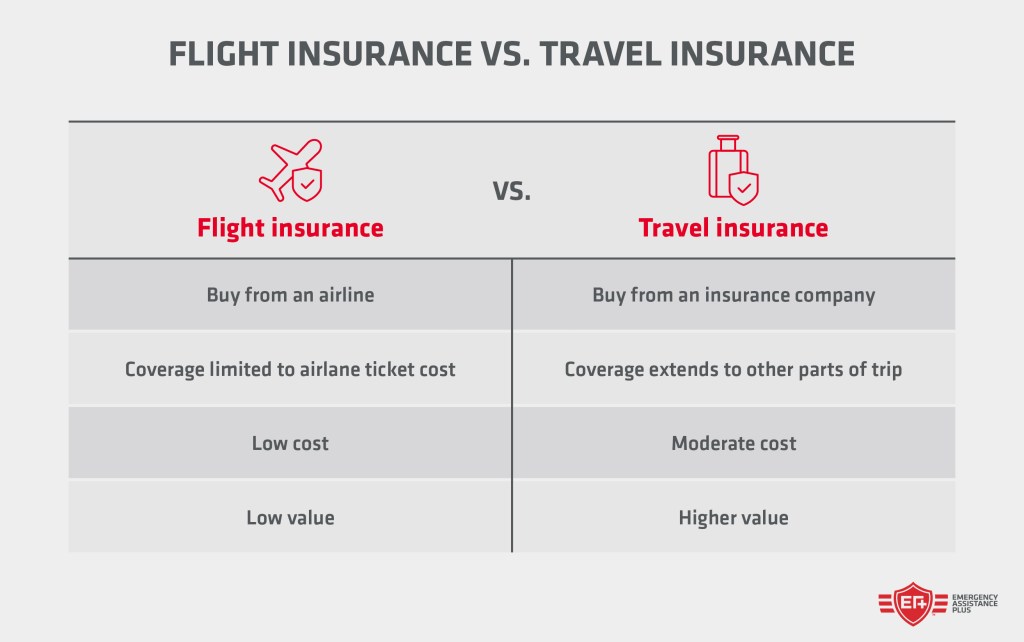

In general, however, the cost of a flight insurance plan will be a fraction of the cost of the flight. According to USA Today, flight insurance from Berkshire Hathaway Travel Protection’s Aircare plan could be $26 for a $1,000 trip. Compare this to the average cost of more comprehensive travel insurance is $61 for a $1,000 trip and you can see that it is indeed the lower cost option.

But is it worth it?

Is a flight insurance policy worth the cost?

In short: Probably not.

The answer to this, of course, is highly subjective, but even though the actual cost of flight insurance is fairly low, so is the value you get from it.

The main reason a flight insurance policy isn’t a great value is because the benefits are pretty much limited to your airplane ticket, which is only a small portion of your trip. For instance, let’s say your flight is canceled: With flight insurance, you’ll likely be reimbursed for the cost of the ticket, but not the hotel at your destination or the rental car you’ve booked.

If looking for a bright side of flight insurance, it usually covers reimbursement of nonrefundable costs that are airline tickets, so you can buy a ticket with a bit more confidence. The downside even to this benefit, of course, is that you’re only reimbursed if the airline makes a mistake; not if you choose to reschedule.

If you’re looking to protect your trip against scenarios like baggage loss, interrupted travel arrangements, medical emergencies, and more, you have better options than flight insurance.

Two alternative ways to protect your trip

1. Comprehensive travel insurance plans

As we mentioned earlier, a comprehensive travel insurance plan will most likely offer protection for your flight as well, but they can offer so much more. Many travel insurance companies offer plans that also have:

And quite a few more areas of coverage. For an in-depth look at travel insurance, please check out this related post.

Ready to explore travel insurance plans? Get an instant quote from TripInsure Plus!

2. Travel assistance memberships

Another option you have to protect yourself while traveling is travel assistance memberships. As opposed to travel insurance, which reimburses financially after you return home, travel assistance is to have a team of experts actually provide you help in the exact moment you need it.

Common services include:

The list above contains actual travel assistance services provided by Emergency Assistance Plus (EA+), but there are far more you can check out on our membership page.

One key thing to note: Travel insurance and travel assistance are complementary services.

While travel insurance may be a good option to reimburse you for missed flight connections or lost luggage, travel assistance will lend you a hand while you’re still on your trip so you don’t have to pay for unexpected medical transportation costs out of pocket.

Additionally, travel assistance plans from EA+ have many services that are also suited for road trips and domestic travel. To learn more, visit our website or call: 866-863-4460.

Should a medical emergency derail your travel, Emergency Assistance Plus® (EA+®) has you protected no matter where you are.

Enroll TodayRelated resources

Destinations

Uncover 30 of the weirdest laws from around the world, from outlawed chewing gum in Singapore to high heel bans in Greece.

Continue Reading

Travel Tips

Planning a trip to a remote area? Learn whether a satellite phone is a must-have for your journey, how it works, and what it could mean for your communication needs.

Continue ReadingIf a medical emergency occurs while you’re traveling—either domestically or abroad—you want to know that you and your loved ones are well-protected. Emergency Assistance Plus not only offers that protection but the peace of mind to explore the world with confidence.