Your honeymoon is a cherished experience. Protect it with the right travel insurance coverage, tailored to the unique needs of newlyweds.

Published on September 5th, 2024 in Travel Insurance, Travel Tips

Do you have an extra special trip coming up, or know someone who does?

There are lots of reasons to go on a honeymoon later in life…

Maybe it’s the start of a second marriage, or maybe life just got in the way and you’re making up for an overdue, extended trip with your spouse.

Either way, when planning a honeymoon, the last thing you want to worry about is something going wrong. Of course, unexpected events can potentially disrupt your plans, making honeymoon travel insurance a vital consideration.

In this article, we’ll break down the basics of honeymoon travel insurance, compare and contrast with other forms of trip protection, provide some hypothetical situations where it might come in handy, and of course, provide some tips on how to find the right solution for you.

Let’s dive in.

What is honeymoon travel insurance?

Honeymoon travel insurance is a specialized type of coverage designed to address the unique needs of newlyweds. It goes beyond standard travel insurance by offering enhanced protection tailored to the romantic and often adventurous nature of honeymoon trips. This can include coverage for high-value items like wedding attire, and specific activities that honeymooners are likely to engage in.

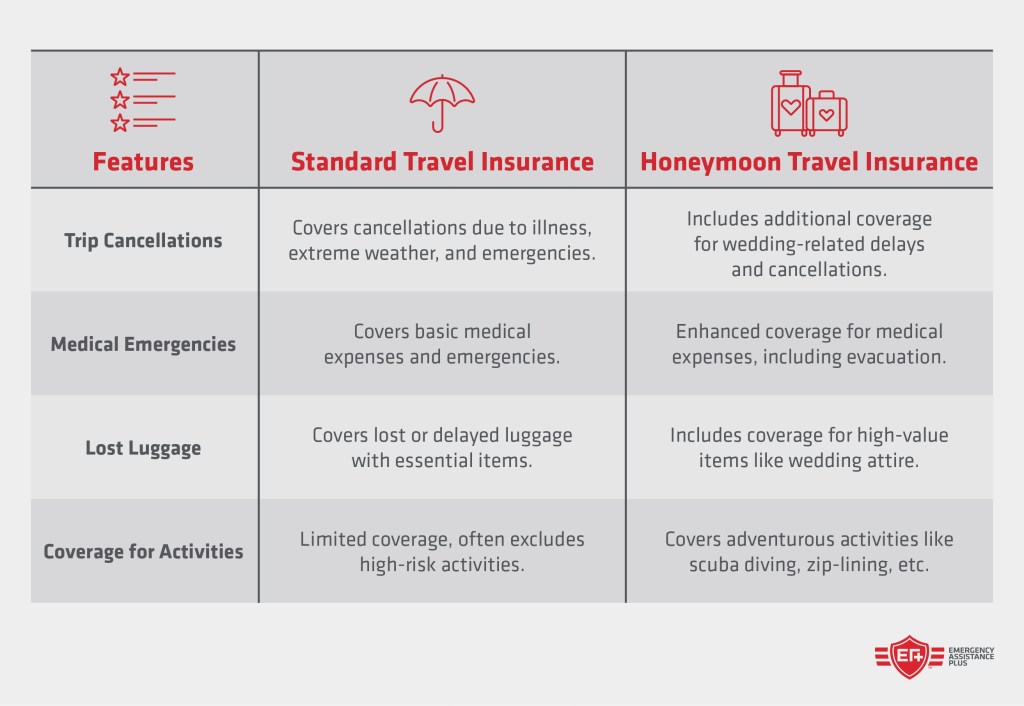

Differences between travel insurance and honeymoon-specific coverage

While regular travel insurance provides essential coverage for trip cancellations, medical emergencies, and lost luggage, honeymoon travel insurance often includes additional benefits.

These may cover the costs associated with rescheduling flights due to wedding delays, protecting expensive gifts, and covering adventurous activities such as scuba diving or zip-lining that are not always included in standard policies.

Why honeymooners should consider this insurance

Honeymoons are once-in-a-lifetime trips, often involving significant investment in both time and money. Honeymoon travel insurance ensures that this special journey remains stress-free, offering financial protection and assistance if something goes wrong. From unexpected medical emergencies to lost luggage, having the right insurance can make a world of difference, allowing newlyweds to focus on creating memories instead of dealing with travel mishaps.

Key features of honeymoon travel insurance

Honeymoon travel insurance provides comprehensive coverage tailored to the unique needs of newlyweds. Here are the key features to look for in a policy:

Coverage for trip cancellations and interruptions

One of the most crucial aspects of honeymoon travel insurance is coverage for trip cancellations and interruptions. This feature ensures that you are reimbursed for non-refundable expenses if your trip is canceled or cut short due to unforeseen circumstances such as illness, extreme weather, or other emergencies. This coverage can also include rescheduling fees and additional travel costs.

Medical emergencies and evacuation

Medical emergencies can be both stressful and expensive, especially when traveling abroad. Honeymoon travel insurance typically includes coverage for medical expenses, hospital stays, and emergency medical evacuations. This ensures that you receive the necessary medical care without worrying about the financial burden, allowing you to focus on recovery.

Note: Honeymoon insurance, like all travel insurance, generally requires you to pay for your medical care upfront, then file a claim in order to be reimbursed at a later date. Travel assistance, on the other hand, coordinates all your medical care and transportation with no out-of-pocket costs to you. Learn more about this unique travel protection.

Lost or delayed baggage

Lost or delayed baggage can be a major inconvenience, particularly if it contains essential items like clothing and toiletries. Honeymoon travel insurance often covers the cost of replacing lost items or purchasing necessary items until your baggage is recovered. This coverage is especially important for honeymoons, where special attire or gifts might be irreplaceable.

Coverage for activities and excursions

Many honeymooners indulge in adventurous activities like scuba diving, snorkeling, or zip-lining. Honeymoon travel insurance can provide coverage for these activities, ensuring that you are protected if an accident occurs. It’s important to check that your policy covers the specific activities you plan to participate in, as not all policies include this coverage.

How to choose the right honeymoon travel insurance

Selecting the right honeymoon travel insurance involves evaluating your specific needs and understanding the various options available. Here’s how to make an informed decision:

Assessing your destination and activities

Your destination and planned activities significantly impact the type of coverage you need. If you’re traveling to a remote location or participating in high-risk activities, ensure your policy covers medical evacuations and adventure sports. Research the healthcare facilities at your destination and consider any potential risks, such as political instability or natural disasters.

Comparing different policies and providers

Not all travel insurance policies are created equal. Compare different providers to find a policy that offers the best combination of coverage and cost. Look for reviews and ratings from other travelers to gauge the reliability and customer service of each provider. Pay attention to the specifics of what each policy covers and any additional benefits offered.

Common exclusions and limitations

Carefully read the terms and conditions of any policy you’re considering. Common exclusions might include pre-existing medical conditions, certain high-risk activities, and incidents related to intoxication or illegal activities. Understanding these exclusions will help you avoid unpleasant surprises when filing a claim.

Tips for getting the best deal

To get the best value for your money, consider the following tips:

Real-life scenarios for honeymoon travel insurance

Understanding real-life scenarios can highlight the importance of honeymoon travel insurance and illustrate its benefits. Here are a few examples:

Example 1: Medical emergency abroad

Imagine you and your partner are enjoying a honeymoon in Bali, and one of you suffers a severe allergic reaction after dining at a local restaurant. Without travel insurance, you would have to navigate a foreign healthcare system and pay out-of-pocket for medical expenses.

However, with honeymoon travel insurance, you would receive immediate medical care and coverage for hospital stays and treatments, ensuring a swift and stress-free recovery.

Note: With a travel assistance membership from Emergency Assistance Plus, all your medical care and specialized travel arrangements would be coordinated for you, all with no out-of-pocket expenses; unlike travel insurance. This includes transportation home and best-in-class companion assistance.

Example 2: Trip cancellation due to unforeseen events

Consider a scenario where your dream honeymoon to Italy is planned, but days before departure, a family emergency forces you to cancel your trip. Without travel insurance, you could lose the money spent on non-refundable flights, accommodations, and tours. Honeymoon travel insurance would reimburse these expenses, allowing you to reschedule your honeymoon without financial loss.

Example 3: Lost luggage with wedding attire

Imagine arriving in Hawaii for your honeymoon, only to discover that the airline has lost your luggage, which includes your wedding dress and tuxedo intended for a post-wedding photoshoot. With honeymoon travel insurance, you would receive compensation for the lost items and funds to purchase new attire, ensuring your special moments are not marred by missing belongings.

Pro tips for honeymoon travel insurance

When it comes to purchasing honeymoon travel insurance, these tips can be invaluable to what is supposed to be the trip of a lifetime.

Travel insurance experts emphasize the importance of thorough research and understanding your policy.

One common mistake is assuming that all travel insurance policies are the same. Many honeymooners purchase insurance without fully understanding what is covered.

Another frequent error is neglecting to declare pre-existing medical conditions, which can lead to denied claims. Experts also caution against waiting until the last minute to buy insurance; purchasing early can protect against pre-departure issues.

And if you end up needing to file a claim, follow these best practices:

————————————————————————————————————————————————————–

We hope you enjoyed this article and that it helps you or a loved one on an upcoming honeymoon.

While honeymoon travel insurance offers essential protection for newlyweds embarking on their dream trip, it’s important to remember that it functions much like any other travel insurance policy. You’ll pay upfront for coverage and, in the event of an incident, be reimbursed later, provided your claim is approved. This process can sometimes be cumbersome, especially if a claim is denied.

That’s why supplementing your honeymoon travel insurance with a comprehensive travel assistance program like Emergency Assistance Plus (EA+) is a wise choice. EA+ goes beyond the limitations of traditional insurance by coordinating emergency medical transportation and assistance without the hassle of upfront payments.

This additional layer of protection ensures you are fully covered, whether you face a medical emergency, a travel disruption, or any unexpected mishap on your honeymoon.

By pairing your travel insurance with a robust travel assistance service, you can enjoy peace of mind knowing that you have taken all the necessary steps to protect your once-in-a-lifetime experience.

This approach allows you to focus on what truly matters: celebrating your new life together and creating unforgettable memories.

Should a medical emergency derail your travel, Emergency Assistance Plus® (EA+®) has you protected no matter where you are.

Learn MoreRelated resources

Destinations

Uncover 30 of the weirdest laws from around the world, from outlawed chewing gum in Singapore to high heel bans in Greece.

Continue Reading

Travel Tips

Planning a trip to a remote area? Learn whether a satellite phone is a must-have for your journey, how it works, and what it could mean for your communication needs.

Continue ReadingIf a medical emergency occurs while you’re traveling—either domestically or abroad—you want to know that you and your loved ones are well-protected. Emergency Assistance Plus not only offers that protection but the peace of mind to explore the world with confidence.